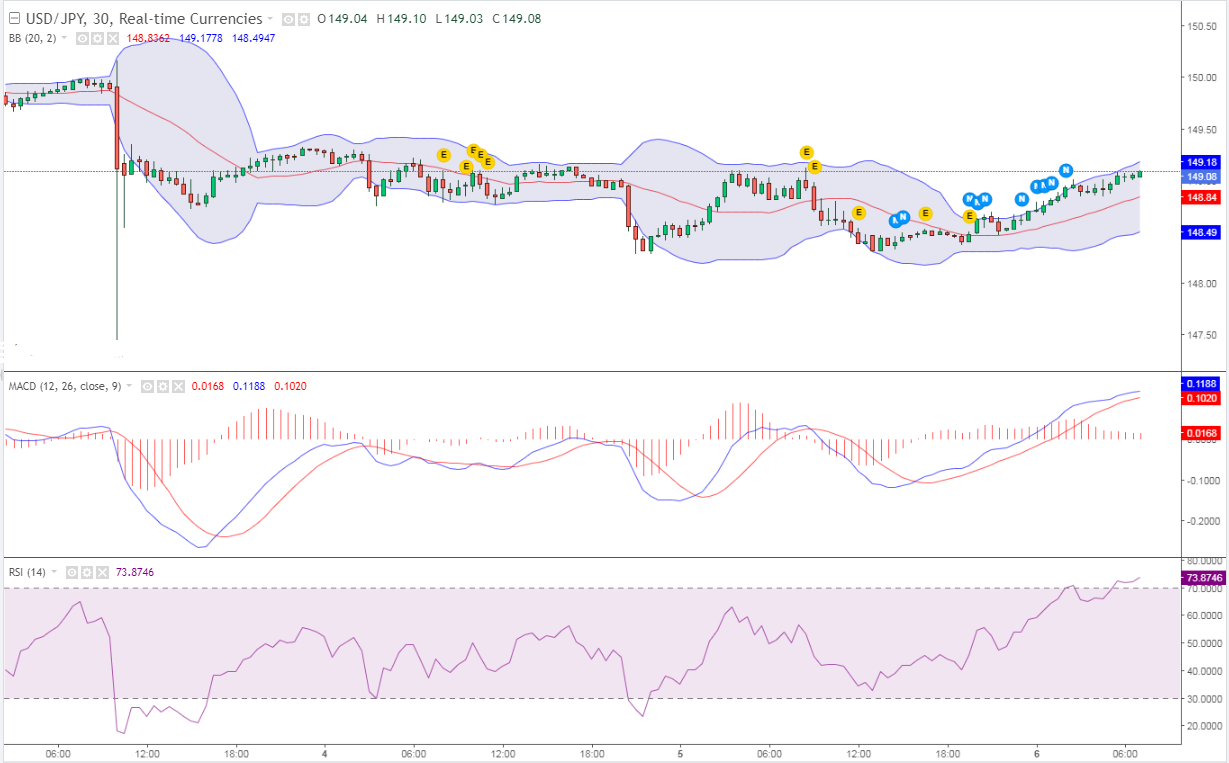

USD/JPY ticks higher during the Asian session, though might struggle to capitalize on the move. Intervention fears, along with a softer risk tone, could benefit the JPY and act as a headwind. Traders also seem reluctant and look forward to the crucial US NFP report for a fresh impetus. The intraday decline showed some resilience below the 100-period Simple Moving Average (SMA) on the 4-hour chart. This comes on the back of a solid rebound from the 200-period SMA on the 4-hour chart, around the 147.30 area, or the lowest level since September 14 touched on Tuesday, and supports prospects for a further near-term appreciating move for the USD/JPY pair. Moreover, oscillators on the daily chart – though have been retreating recently – are still holding comfortably in the positive territory. This, in turn, favours bullish traders and suggests that the path of least resistance for the USD/JPY pair is to the upside. Any subsequent move up, however, might confront some barrier near the 149.60 area, above which bulls might aim back to challenge the 150.00 intervention level.

Leave a Reply